Content

LiteForex’s minimum deposit for both accounts is $50, and the main difference is the spread. On the ECN account, the broker takes a commission of $5 on all of the accounts in other currencies, while limefx scammers for the Classic account, there are no fees besides spreads and swaps. Broker copy trading system implies a system where traders can copy trades from the most successful investors and profit this way.

After opening the website, traders have to click on the register button on the top right corner of the landing page. The only information required by the platform to register a trader is the email address and a chosen password. Next, the verification link is sent to the given email address, and registration is completed after clicking on the link. For the past 6 days, I have not had any access to the money I have deposited on this site, and according to the administrators, those servers have crashed. We use dedicated people and clever technology to safeguard our platform.

Available in 22 languages, the MT4 and MT5 mobile apps are suitable for iOS and Android (APK) smartphone and tablet users. The apps come with the same features as their desktop counterparts and allow for full-fledged technical analysis with custom charting tools and trade execution capabilities. LiteForex Europe has an extensive mobile app offering, consisting of not only the MetaTrader apps but also the broker’s own apps tailored to forex signals, analysis, and strategies.

Reviews

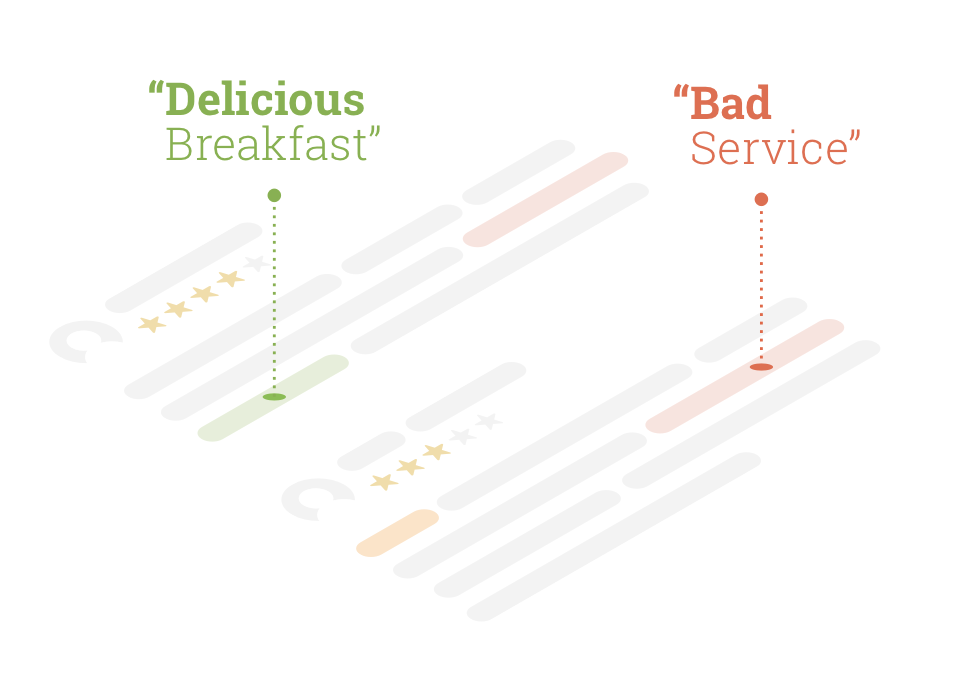

I like this service, the withdrawal of profit is an exciting moment and there is always a fear that something will go wrong as you want and think. LiteForex has a rating of 4.08 stars from 24 reviews, indicating that most customers are generally satisfied with their purchases. LiteForex (Europe) does not offer any promotions, including no deposit bonuses. You can also get help 24/5 by clicking on the live chat logo, which is available upon login to a demo or live account.

Then, unexpectedly for investors, it expanded the range of target bond yields. Nathan Ferguson is a talented crypto analyst and writer at Herald Sheets, dedicated to delivering comprehensive news and insights https://limefx.club/ on the ever-evolving digital currency landscape. With a strong background in finance and technology, Nathan’s expertise shines through in his well-researched articles and thought-provoking analysis.

Pros and cons of LiteForex

This industry-standard software comes with a raft of features and benefits and is recognized for its data security features, analytics tools, and quick execution times. No, LiteForex is not a scam, the broker is highly regulated and authorized by a top-tier regulatory body ensuring trading safety. We marked that the broker took all the necessary steps to improve the trading experience and provide transparent conditions after traders’ complaints. I like the trading environment at LiteFinance for cryptocurrency traders who seek a copy trading service. LiteFinance, previously known as LiteForex, faces technical issues and experiences a rise in fraud claims.

For bank deposits/wire transfers, the minimum deposit should be at least $100. Overall, Liteforex is a dependable broker with a range of low-deposit accounts that are suited more to beginners than experienced traders on the MT4 and MT5 platforms. Its variable spreads average at 2.0 pips, which is significantly wider than other brokers. Classic Accounts only allow base currencies to be denominated in USD, EUR, and MBT. The minimum deposit on this account is 50 USD, and transactions start at 0.01 lots. Support is offered for both the MT4 and MT5 trading platforms, Stop Out levels are at 20%, and no interest is charged on surplus funds.

The seductive reports of success in the realm of forex trading tempt almost all of the traders all over the world. That’s why there are so many demands for finding the best broker of forex. A forex broker who is a financial company providing foreign exchange services helps traders access the platforms for buying and selling foreign currencies. Finding the right one which could have more appropriateness with your conditions is significant. One of the famous brokers is LiteForex, which you will know more about in this article. LimeFx is a competitor brokerage firm that holds a great reputation among traders and financial experts in the forex market.

LiteForex Customer Support

The terminal is compatible with any operating system, including MacOS, and is accessible once you have your account login details. LiteForex Europe’s advanced trading solution is the MT5 platform, designed with the professional trader in mind. The platform boasts dozens more technical indicators than its predecessor, 21 timeframes, and a full set of order types.

- Clients of ECN accounts also get the security of negative balance protection so that they are not liable to pay the firm in case of massive loss.

- Also, money transfers to or from the account depending on your residency and its applicable policies, in addition to entity rules of LiteForex that apply.

- There are separate trader agreements signed to charge zero inactivity fees, which is why LiteForex is preferred over other brokers.

- To facilitate mobile trading, these platforms are also available as a mobile app, allowing clients to start investing at their convenience.

LiteFinance caters to most international traders, including the UK, the Philippines, Malaysia, and Nigeria. Like most international brokers, LiteFinance does not accept traders from the US. LiteFinance does not provide any of the necessary third-party add-ons to unlock the full functionality of MT4/MT5 and improve the trading environment. The present choices will leave traders with an incomplete and sub-standard experience unless they are willing to invest in upgrades.

fake site that pretends LiteForex

Nowadays, LiteForex broker is one of leading brokerage companies that unites traders worldwide. LiteForex is on the top 100 companies list according to World Finance. LiteFinance provides access to trade a good selection of currency pairs which represents the major, minor and exotic crosses.

Even when Liteforex offers all the right mediums of communication on its platform, the reputation of the customer service of this broker is not so good. The customer reviews suggest that customer support is slow and prompt responses are not given. Regardless of these reviews, the initiative taken by Liteforex of social chat and trading channels is commendable as it is not available on most of the brokerage platforms. As ECN accounts are intended for professional traders and investors, the commission rate is $ 5 per lot, unlike the commission-free classic accounts.

We do not provide financial advice, offer or make solicitation of any LimeFxs. The MetaTrader platforms are already packed with plenty of tools that should be enough for most traders. You can get loads more from the MQL marketplace within the platform and use the MQL editor to develop your own. If you don’t have the coding skills, you can always hire a freelancer to bring your ideas to life. That being said, LiteFinance does provide a few additional tools to help with your day trading routine.

Despite these potential drawbacks, MT4 and MT5 platforms are fast, reliable, and provide access to a range of trading instruments, making them a popular choice among traders. LiteForex offers its clients a wide range of trading markets that includes currency pairs, indices, metals, and energy. This variety of instruments allows traders to find what they want to trade on the platform, whether they are beginners or experienced traders. However, it is important to note that LiteForex does not offer cryptocurrencies and stocks currently. Additionally, there is no information available on the number of instruments offered on the platform, and it is unclear if exotic currency pairs are available for trading.

I like how they integrate comprehensive market analysis by a third-party firm in Claws & Horns. Despite this, LiteFinance could improve its limited list of assets in order to remain competitive with the best brokers. The commission and fees are also not the lowest that I have come across.

Unlike other brokers that offer a range of account types with lower spreads linked to higher minimum deposits, LiteForex offers three market-execution accounts with low minimum deposits. The Classic and Cent Accounts have the trading costs included in the spread while the ECN Account offers tighter spreads and a small commission per trade. Liteforex is a brokerage platform that has been providing trading services to customers globally since 2005. This firm is regulated by the Cyprus securities and exchange commission (CySEC) and has specifically made its name as a reputable ECN broker in the financial markets. Moreover, at Liteforex, passive traders can benefit like active traders due to its social trading platform.

- After becoming aware of the advantages and disadvantages of this broker, it is time to go for its features and characteristics in detail.

- Despite 16 years as a brokerage, LiteFinance, previously known as LiteForex, appears to undergo unfavorable changes.

- For the commission-free Classic account, clients get elevated floating spreads, which start at 1.8 pips.

- Other trading instruments are available but are very limited compared to other brokers such as LimeFx who have thousands for you to choose from.

The procedures for making deposits and withdrawals are also straight as an arrow so traders find no difficulty at all. In addition, educational material is also available on the website which includes summaries, eBooks, and tutorials. This material covers all the aspects related to online trading such as investing, economics, and financial markets. To support its clients, the technical assistance of these trading platforms is available online. These platforms can be used 24/7 and are free to use in every country in the world. The support staff is unable to deliver timely results under such conditions.

Forex trading is so competitive that it sometimes seems that it is going to be so tricky. That’s why it is suggested to use one of the forex brokers like the LiteForex, proving that it could be beneficial for most traders. The only critical thing is that traders must be careful in choosing any type of account. That’s why you must go for the reviews of different brokers and choose the best one by high certainty. Liteforex is a safe and secure brokerage patform as it has been providing trading services to since 2005 to customers across the world. Moreover, unlike many other brokers, Liteforex uses the HTTP protocol whenever the client’s data is being transfered to the brokers server.

If clients consider trading stocks at the weekends, then there is no customer service at their disposal. As a result, their profit margins get lowered, and the trade profitability reduces by being active only on weekdays. Changes in the standard trade hours are immediately reflected in the broker’s services.

LiteFinance launches new mobile app on Google Play – FinanceFeeds

LiteFinance launches new mobile app on Google Play.

Posted: Tue, 24 May 2022 07:00:00 GMT [source]

I always recommend that traders check them before evaluating the total trading costs. Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. LiteFinance maintains one regulated subsidiary for EEA, UAE, and Marshall Islands-based traders. I have ECN account with this broker, I opened it a few months ago, so far they seem nice. All my entries and orders were executed without

Delays and any problems.