Contents:

Traders can use their demo accounts for a period of 30 days to test the platform and familiarize themselves with its features. For this purpose, Axi will give them a starting cash balance of $50,000. The app also enables you to make better-informed decisions when trading. It presents you with different customizable candlestick and pie charts. The mobile version is rather simple to use but if you experience any difficulties, you can always reach out to the live chat support. Another useful functionality is the MetaTrader 4 Forex Trading Signals tool.

The stock index, commodity, crypto and stock CFD selection is average, although it is constantly expanding. Meanwhile, other products, such as stocks, axitrade ETFs and bond CFDs are not available. Similarly to the web trading platform, Axi provides only a one-step login.A two-step login would be safer.

There are two Axi account types that impact the fx broker costs when trading with Axi. The regular analysis includes a weekly market preview, charts of the day, charts of the week, and a daily briefing on the market open. Axi offers an excellent range of trading tools that integrate seamlessly with the MT4 platform. We tested Axi’s MT4 app on an i-phone 11 and found that it synced well with the desktop and web trader versions. It allows traders to monitor and modify their trades, manage their accounts, add stops to positions, and delete orders.

He received his MSc degree in International Business from the University of Middlesex. This allows you to identify successful traders and follow their trades, which are then translated into real trades in your own broker account. To access this feature, you have to download the Axi Copy Trading platform, then link your MT4 account to it. You can use either bank card, bank transfer or e-wallets for deposits, but there are some withdrawal limitations for bank cards.

Trading Platforms

The platform functions efficiently and makes your day to day trading a breeze. Aside from the desktop version of the site, you can access the AxiTrader Australia mobile app as well. It is a streamlined and exceptional mobile app that offers you just about everything that the desktop version of the platform does. You can download the app for Android and IOS so no one is getting left behind. To give you an idea of just how highly we rate the AxiTrader platform in terms of usability we suggest comparing it with our Eightcap review. Please note as soin as we will receive the funds we will add to your axi trading account.

Free webinars are conducted regularly, where you can access live analysis from Axi experts and acquire new skills in real-time. A news section that keeps traders up to date with the latest events in the markets. While Axi offers a good support service, they do not deserve our top mark here since they do not offer support service over the weekend , unlike peers such as IC Markets. If you have not made a withdrawal before, please note that all requests will be processed within 1-2 business days upon receipt.

If you prefer to get a print version that you can download for offline reading, then they include their free ebook. You will need to hand over your contact details in order to get sent the ebook. We downloaded the book and it appears to be pretty stock and standard . The MT4 platform is also much more sophisticated than any other technology that has been developed in house by a broker.

Retail Clients of Australia and New Zealand are given the added protection of negative balance protection. This means that you cannot lose more than the amount of money invested with us. Investing in CFDs does not provide any entitlement, right or obligation to the underlying financial asset.

Bad experience with the company and the broker

The whole process can take you less than 15 minutes depending on how busy the AxiTrader team is at the time. Education What is the Ichimoku Cloud trading strategy and how to use it? Milan Cutkovic Get a basic understanding of how the Ichimoku Cloud indicator works, and how you can use https://forex-reviews.org/ it within your trading strategies. Trading on AxiTrader Standard account, you only need to pay for the spread, which is the difference between the buy and sell price. Hi Ricardo, please note that the difference in the amount is due to bank fees which Axi does not have control over.

During the London-New York overlap session, I received a 1.1 pip spread for the EUR/USD or $11 per 1.0 standard lot. It is an above-average trading cost, and I recommend traders avoid it. The commission-based Axi account delivers as advertised, with raw spreads of 0.0 pips for a commission of $7.00 per round lot, which resembles a competitive pricing environment.

It has a plethora of charting functionality as well as technical analysis. It also allows you to code your own bots or “EA” in order to automate your trading. For those who do not know, MT4 is a third-party trading program that was developed by a company called Metaquotes. This is one the most widely used external trading software currently on the market. While this looks like a pretty attractive asset offering, there seems to be a distinct lack of any single name equities to trade.

The MT4 trading platform is available as a desktop application for Windows and Mac computers, WebTrader, and a mobile app that is compatible with Android and iOS devices. The WebTrader can be accessed through all popular web browsers, such as Chrome, Safari, Firefox, and Edge. If you are looking to make your first deposit on the site, you can do so by using credit/debit card, POLi, Neteller, Skrill, Global Collect, and bank transfers. The longest processing times from these options will be global collect which can take up to 5-business days to clear and bank transfers which can take up to 3.

Inactivity Fees

The download and the set-up of the software are entirely free of charge. Keep in mind that crude oils are a very volatile category of commodities. Trading crude oil CFDs via the AxiTrader platform is a great way to diversify your trading portfolio and manage your risk with a proper strategy.

- Axi requires a minimum deposit of $0 for all live account types, and it will not charge any fees on deposits.

- The margins for precious metal CFDs are as low as 1% at AxiTrader, so your exposure to risk remains minimal.

- The trading services provided by Axi are overseen individually by the financial regulators of the respective countries the platform is available in.

- There are zero transaction fees for your deposits and withdrawal on the platform.

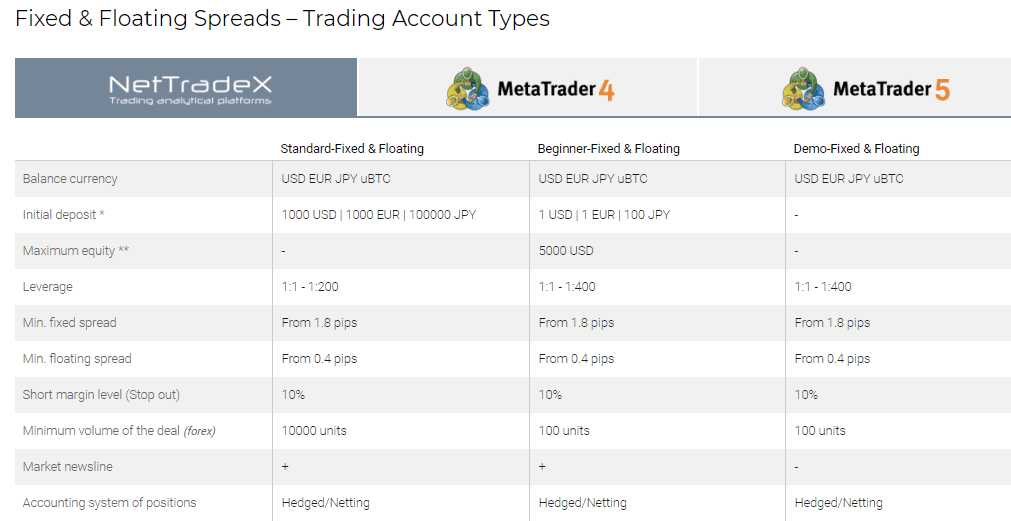

At Axi, prospective customers are presented with a choice from several account types. Those who are completely new to this trading platform are granted the option to set up a free demo account. Versed traders can choose from standard, professional, and elite accounts, all of which are entirely free to set up. Each type of live account has a distinctive minimum spread and minimum deposit requirement.

Lower fees, lower costs?

With a minimum deposit of 500 AUD you will get access to PsyQuation Premium. PsyQuation is one of the world’s most advanced data analytics plugins for retail traders. Using highly sophisticated algorithms, it works like a trading coach, analysing your trading style, identifying mistakes, and helping you avoid making similar mistakes again. The wide range of base currencies available at Axi allows for traders to do this and is welcomed. We were impressed to find that both Axi’s minimum deposits and ongoing trading costs are significantly lower than most other brokers. Axi’s range of financial instruments is slightly limited compared to other brokers, but it offers over 70 Forex pairs and has recently added share CFDs.

This simple approach results in faster execution, more accurate pricing, and minimal slippage. Another benefit of Axi’s execution model is direct order filling with no requites. Axi offers a reliable ECN execution of trade orders with no dealing desk intervention. An ECN model of operation boosts client trust and allows for breakneck execution speeds.

They have an extensive track record in the industry and are well known for their relatively attentive customer service and extensive asset coverage. They also have a range of trading platforms and give traders numerous customisation options. The FCA and ASIC are top-tier regulatory authorities that provide traders with the assurance that a company is fully transparent and ethical in its business dealings. Tier 1 regulation also mandates that all client funds are kept fully segregated from the broker’s corporate accounts in client trust accounts at top-rated banks. This way, the risk of fraudulent behavior by the brokerage is kept at a minimum. Axi requires a minimum deposit of $0 for all live account types, and it will not charge any fees on deposits.

Ultra-competitive pricing and fairer charges, so more of your money is invested in the markets. Nonsense, as I have made 100s of wire transfers to brokers in Australia. Well, here is my feedback, closing my account and cannot be bothered no more. Reply by Axi submitted Nov 18, 2022 Hi Ricardo, thank you for taking the time to leave us a review. Your withdrawal request on the 26th of October was sent to your bank account that same day. In most cases your funds will be available in a matter of hours, however please allow one to three days for bank transfers.