A general ledger represents the record-keeping system for a company’s financial data, with debit and credit account records validated by a trial balance. It provides a record of each financial transaction that takes place during the life of an operating company and holds account information that is needed to prepare the company’s financial statements. Transaction data is segregated, by type, into accounts for assets, liabilities, owners’ equity, revenues, and expenses. The main purpose of an accounting ledger is to keep track of all financial transactions that have taken place within a business. It allows users to gather information on sales, purchases, and cash flow which can be used for reports such as balance sheets and income statements.

Credits increase liability, revenue, and equity accounts and reduce assets and expenses. Ledgers also provide the ability to prepare reports such as balance sheets and cash flow statements which can be used by business owners, managers, and employees for decision-making purposes. Financial transactions posted into the ledger are broken down by type into specific accounts whether they are classified as assets, liabilities, equity, expenses, and revenues.

What is a bank statement?

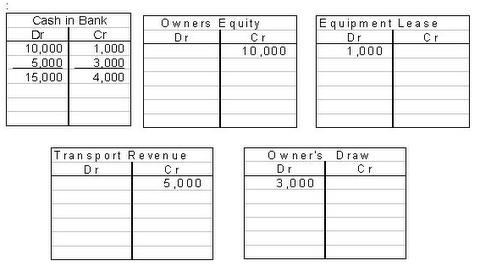

Following is an example of a general ledger report from FreshBooks. It shows all of the activity for accounts receivable for the month of April, including debits and credits to the general ledger account and the net change to the account for the month. Summarize the ending balances from the general ledger and present account level totals to create your trial balance report. The trial balance totals are matched and used to compile financial statements. A ledger is a book or digital record that stores bookkeeping entries. The ledger shows the account’s opening balance, all debits and credits to the account for the period, and the ending balance.

- Debits increase asset and expense accounts and decrease liability, revenue, and equity accounts.

- If the totals of the two sides of the account are equal, the balance will be zero.

- The balance is calculated after a certain period (or when needed).

- The company’s bookkeeper records transactions throughout the year by posting debits and credits to these accounts.

- In the double-entry system, each financial transaction affects at least 2 different ledger accounts.

According to V. J. Vickery, “Ledger is a book of accounts which contains in a suitably classified form, the final and permanent record of trader”s transactions.” Any increase in capital is also recorded on the credit side, and any decrease is recorded on the debit side of the respective https://accounting-services.net/how-to-calculate-fixed-manufacturing-overhead/ capital account. For example, if the business owner needs to know the total amount of purchases relating to a specific accounting period, it will be difficult to find this information in the journal. In a trial balance, debit is on the left side and credit on the right.

What are the types of accounting ledgers?

The entity has to record daily transactions to identify the actual sales . Books of Accounts are always required to be in a format prescribed by the tax authorities. These show the transactions Ledger is the Main Book of Accounts. It is The which took place beyond the permitted limit. The ledger might be a written record if the company does its accounting by hand or electronic records when it uses accounting software.

Batches or groups of similar accounts are kept together, and ledgers are indexed so that information pertaining to a particular account can be obtained quickly. Also known as the general ledger, the ledger is a book in which all accounts relating to a business enterprise are kept. However, the business owner can easily find the total purchases amount from the purchases account. The term used for matching the entries with the bank account is bank reconciliation. Any unreconciled entries are referred back to the accounts department to find and match the transactions. It contains all the transactions which are done in cash for a particular period.

Self-balancing Format

It includes description of the item, date of transaction, the amount involved, sold on cash or credit, the amount involved in the sale. Thus, the records from the journal are filled into a ledger in the same classification. A nominal ledger houses all nominal accounts such as rent, depreciation, sales, etc.

The small business entities having low turnover or run by 1 or 2 persons. Need not keep a record of transactions as the transactions are limited. The general ledger should include the date, description and balance or total amount for each account. A purchase ledger is used to keep track of all the purchases made by a business.

The equation remains in balance, as the equivalent increase and decrease affect one side—the asset side—of the accounting equation. In this instance, one asset account (cash) is increased by $200, while another asset account (accounts receivable) is reduced by $200. The net result is that both the increase and the decrease only affect one side of the accounting equation. Using a ledger, you can maintain an accurate record of your business’s financial transactions, generate financial reports, and monitor business results. Both the accounting journal and ledger play essential roles in the accounting process. Bookkeepers primarily record transactions in a journal, also known as the original book of entry.

What is the main book of accounts called?

All the transactions from journal are posted to ledger which consists of different accounts on the basis of transactions recorded in journal. Hence, it is regarded as the second important stage in the accounting process and also considered as the main books of account.

It is the principal book of the account which make a final record of all the transaction in a classified manner. From the given definition, we say that a ledger is a bound or register book which contain a large number of the account. With the help of ledgers, users can gain a better idea of what is going on inside their company so they may make more informed decisions and effectively manage their finances. If he draws any money or goods from the business, this will reduce his capital, meaning that an entry should be made on the debit side of his capital account.

The cash transactions have to be matched with bank transactions to find out the proper use of money. The transferring of a transaction from a journal to a ledger a/c is called posting. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. For example, when furniture is bought on credit for $4,000 from Fine Furniture Co., we will need to make an entry of $4,000 on the debit side of the furniture account (i.e., because this asset is increasing).