Content

Real estate investors will receive immediate expensing of certain assets with 5, 7, and 15-year MACRS useful lives. Inverters have shorter useful lives, typically half that of the panels themselves, and more closely align with the five year MACRS solar treatment. This also benefits customers by having lower-cost projects than https://accounting-services.net/double-declining-balance-depreciation-method/ they otherwise would have under a general depreciation system (GDS). This benefits companies by having the time value of money benefit them, and presumably, from society’s point-of-view, reinvest more capital into the economy. The new law increased the maximum one-time section 179 deduction from $500,000 to $1,000,000.

To understand this better, let’s look at a 200% declining balance depreciation example. For example, if a taxpayer purchases a piece of equipment to be used in a business and it costs $50,000 but has $5,000 in shipping and installation costs and $3,500 in sales tax. By allowing used property acquired after September 27, 2017 to qualify for this special treatment, it can also qualify for bonus depreciation when assessed using a proper cost segregation study (discussed below).

Selection of the Depreciation Method:

By contrast, the opposite is true when applying the straight-line method, the unit-of-production method, and the sum-of-the-years-digits method. Riley Adams is a licensed CPA who worked at Google as a Senior Financial Analyst overseeing advertising incentive programs for the company’s largest advertising partners and agencies. Previously, he worked as a utility regulatory strategy analyst at Entergy Corporation for six years in New Orleans. So long as you provide tax incentives for certain actions, businesses will plan to take advantage of any available opportunity to improve the profitability of their operations. While there is much debate about the effectiveness of the MACRS system, many corporate managers have not shown bias toward the tax benefit and taken advantage of it nevertheless.

- Generally, it is best to choose the higher macrs depreciation rates in the earlier years for maximum tax savings.

- We have looked at MACRS depreciation, but let’s look at the traditional depreciation method used by companies to record depreciation expense on their books.

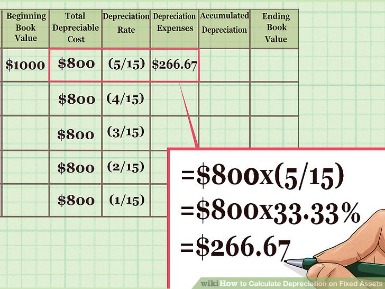

- The system applies changing fractions each year to the adjusted cost of the asset.

- Therefore, if you know Freshbooks is the right choice for your business needs, consider locking in the discounted pricing for your first 6 months and taking advantage of the powerful accounting and business management software.

Accelerated depreciation results in reducing the amount of taxable income in the immediate future by recognizing increased depreciation expenses sooner. Well, these are the MACRS depreciation methods that are based on the IRS (Internal Revenue Service). Calculating depreciation using macrs methods becomes easy with the ease of IRS depreciation calculator. Declining or reducing method of depreciation results is diminishing balance of depreciation expense with each accounting period. This means more depreciation occurs in the beginning of useful life of an asset. Depreciation expenses keep reducing with each passing accounting period and the least towards the end of the useful life.

MACRS Depreciation Formula:

Under the mid-month convention, the taxpayer treats the property as placed in service in the middle of April. The adjusted basis of the office building (land excluded from value) amounts to $100,000. After looking at the half-year convention above, let’s also look at the mid-month convention which applies when the asset placed into service qualifies as real estate.

Combined with other tax deductions, MACRS depreciation can be a valuable tool to lower the taxable income of a taxpayer. Taxpayers want to depreciate their assets as quickly as possible because this lowers their taxable income and allows for greater investment potential in their business. For calculating the amount of deduction to take under the MACRS depreciation formula, certain timing conventions must be used when placing an asset into service. In particular, let’s review the MACRS mid-month, mid-quarter, and half-year conventions. We have looked at MACRS depreciation, but let’s look at the traditional depreciation method used by companies to record depreciation expense on their books.

Straight-Line Depreciation Example

The MACRS convention is a rigid set of tax rules which allow a certain amount of tax depreciation depending on the asset classification assigned to property. The Accelerated Cost Recovery System (ACRS) was a U.S. federal tax depreciation methodology put in place from 1981 to 1986. When a taxpayer depreciates the property and adjusts the basis downward, this asset has a lower adjusted basis or tax basis of the asset. As time passes, the adjusted basis will continue to decline unless an improvement is made to the asset. The PATH Act not only extended bonus depreciation rules under IRC § 168(k), modified percentages and made other provisions permanent, it also extended bonus retroactively to January 1, 2015 through December 31, 2019. Under tax reform and subsequent legislation, the limit for 2022 is $1,080,000 for new or used personal property acquired from an unrelated party.

Is 150% declining balance a faster depreciation method than straight-line?

150% declining balance is a faster depreciation method than straight line. Using double declining balance depreciation, annual depreciation will decline by a constant amount each year. A single-entry accounting system does not maintain current values for assets and liabilities.

In most cases, the allowable depreciation taken on MACRS property results in the same total depreciation as GAAP or IFRS depreciation. Congress eventually saw the rapid depreciation companies took under ACRS and saw the distortion which occurred between cash flow and reported earnings. Be sure to review the state-by-state breakout of state conformity with these depreciation provisions.

Sample Full Depreciation Schedule

Where applicable, other self-employment tax deductions can reduce taxable income further. For greater detail on the types of property and their MACRS depreciation method, see the IRS depreciation table below. The straight-line depreciation formula would show $1,000 of book depreciation expense taken each year. Congress put MACRS in place under the Tax Reform Act of 1986 and allowed the capitalized cost basis of property to be recovered over specific asset useful life categories, which range from 3 to 39 years in length.

Enter the inputs and find out the rate and expense amount for personal or real property for a given year. This is how you can take advantage of the Percentage (declining balance) depreciation method calculator. Below are the steps that need to be followed while calculating depreciation with the help of this method. Let’s take the example of a laptop with the initial value of £3,000, expected final/ residual value £1,000 and life span of 4 years. They lose their value gradually, but useful life span of these assets cannot be estimated precisely. For instance, a car that you bought for £10,000 may depreciate 20% that is £2,000 in the first year of purchase.

Simply select “Yes” as an input in order to use partial year depreciation when using the calculator. If you use the MACRS Alternative depreciation method, you must indicate the inception-to-date (I), current period (P), or remaining life (R) method of computation. Under the declining balance methods, the asset’s salvage value is used as the minimum book value; the total lifetime depreciation is thus the same as under the other methods. Financial accounting applications of declining balance are often linked to income tax regulations, which allow the taxpayer to compute the annual rate by applying a percentage multiplier to the straight-line rate. Examples of personal property reclassified under a seg study include a building’s non-structural elements, exterior land improvements and indirect constructions costs.